Saunders Insurance Agency Blog

Want a Safer Home? Consider These Inexpensive Fixes

Home improvement: It’s a never-ending process for many people, and for those of us who aren’t necessarily handy, it can be a hassle, too.

But there are plenty of simple maintenance tasks and other improvements you can handle to make your home safer – whether you’re handy or not. And you won’t have to break out the power tools (or any tools at all in some instances) or worry about getting in over your head.

Water Works

You need running water in your home – but not water running in your home, if you know what we mean. Even minor leaks can cause major problems, from higher water bills to damage requiring costly repairs (maybe even the kind you can’t tackle yourself). Here are some easy ways to make sure your water stays where it should:

-

Check your appliances. They’re the most common source of water leaks in homes, so it’s worth taking a look at least once a year to check for problems. And the hoses that come with your washer and dishwasher can mean big trouble – they break down over time. Look for kinks and cracks, and replace if needed. Consider using reinforced hoses, too; those with steel braiding or mesh won’t hold up forever, but they’re stronger than rubber or plastic.

-

Watch the pressure. Water pressure that is set too high can cause pipes, hoses and water lines to leak or burst. Inexpensive gauges are available at home-improvement stores to test your pressure.

-

Consider installing water sensors. These can alert you to a leak or other problem soon after it occurs – some can even send messages to your smartphone.

Keep Your Family (and Your Guests) On Their Feet

Millions of Americans – many of them older adults – are injured in falls each year. About 2.5 million were hurt in 2013 alone, according to the National Safety Council and the Centers for Disease Control and Prevention. Look around your home. Should you make some of these fixes?

-

Reduce clutter. Everything from small pieces of furniture to area rugs can pose a hazard, so make sure they’re in appropriate places and out of the way if possible.

-

Add stability to stairs. Make sure stairways have sturdy rails, and maybe even non-slip strips, particularly outdoors.

-

Let there be light. It’s hard to walk safely when you can’t see obstacles or potential trouble spots. Make sure your home is well-lit, and don’t forget night lights, too.

Give Everyone Some Air

Pollution isn’t just an outside thing – the air in your home can be unhealthy, too. But helping people breathe a little easier isn’t hard when you follow these steps:

-

Test the air (and your detectors). Make sure you have working carbon-monoxide and smoke detectors and test them regularly. Also, consider testing your home for radon, a naturally occurring radioactive gas that can be dangerous over time.

-

Check your filters and ducts. Keeping your furnace filter and air ducts clean will keep your air cleaner as well. And consider adding some of nature’s air filters: plants.

-

Keep your home clean. Dust doesn’t just build up on the furniture – it ends up in the air as well. Regular cleaning means cleaner air (just be sure to use safe products).

Home improvement doesn’t have to mean a kitchen remodel or finishing the basement. Making your home safer, in fact, just might be the best improvement of all.

Reposted with permission from the original author, Safeco Insurance®.

Top image by Flickr user CORGI HomePlan used under Creative Commons Attribution-Sharealike 2.0 license. Image cropped and modified from original.

Think Renter’s Insurance is Only for Your “Stuff”? Think Again!

Clients often think they don’t need Renters insurance — “Nothing I have is worth that much,” they’ll say, or “I don’t have a lot of stuff.”

That’s how most people think of renter’s coverage: protection for stuff, and nothing more. After all, it’s inexpensive and it doesn’t even cover the structure itself. So how important can it be, especially if you don’t think you have anything valuable to protect?

Plenty important, because you have more to protect than you realize. You just have to stop thinking only about “stuff.” Here are three key financial protections a Renters Policy provides:

Loss of use coverage. What would you do if a fire or other issue forced you out of your apartment or home? You’d have to find a temporary place to stay, maybe even for months — which might cost you more than your normal rent. Loss of use helps cover that and other additional expenses.

Personal liability protection. If someone trips and injures themselves in your unit, they could sue you. If your dog bites one of your guests, they might file suit, too. Yes, lawsuits happen — even among friends. Renters insurance can help cover legal expenses and even judgments against you. (Some dog breeds may disqualify you from coverage, so be sure to inform your agent of all dogs in the household.)

Personal property coverage. Wait, doesn’t this mean your stuff? Well, yes. But really, this coverage protects your finances. Even if you don’t think you have anything valuable, take a minute and mentally add up everything you own (note that if you do have any high-value items, such as jewelry or heirlooms, you may need additional coverage). Now imagine how much it would cost to replace it all. It’s probably a higher number than you thought — and that’s why renters insurance is so important.

Reposted with permission from the original author, Safeco Insurance®.

Top image by Flickr user Emily May used under Creative Commons Attribution-Sharealike 2.0 license. Image cropped and modified from original.

Winter is Coming. Are You Ready?

Posted January 22nd, 2019

We admit it: As insurance pros, our picture of winter isn’t exactly cozy. Winter storms mean traffic snarls, hillsides turning to sheets of ice, and cars sliding around like hockey pucks. Cold temperatures can cause pipes to burst, frost swells and other damage. Heating your home with fireplaces and holiday lighting can increase the risk of fire.

A picture-perfect winter requires a few precautions

Here are a few of our top tips to help reduce weather-related hassles this winter.

-

Winter-proof your car with good snow tires or chains, new wiper blades, antifreeze, and emergency road supplies.

-

Keep your attic cool to help prevent ice dams. Insulate the attic floor and make sure it is well-ventilated.

-

Do not overload circuits with holiday decorations.

When winter storms hit, be smart

If you do not have to drive, stay put. If you must drive, make sure you’ve winterized your car and have a full tank of gas.

When the air is cold, keep bath and kitchen cabinet doors open so warm air can circulate around pipes. If pipes do freeze, let them thaw normally—they’ll be less likely to burst.

And if the power is out, make sure you avoid leaving candles or fires burning unattended. If you use a portable generator, follow the instructions and do not use it indoors.

Know what your insurance covers

We want to help you rest easy. You will be more relaxed when you know you have prepared your property to lessen the chance of winter storm damage. Your insurance policy covers repair or rebuilding costs. However, your deductible does apply. Check your policy to see what is covered and to confirm the deductible you have chosen.

If you have any questions at all about your coverage, call Saunders Insurance Agency at 740-446-0404 and we will help you review your options.

Posted December 17th, 2018

EXCLUSIVE SAVINGS FOR UNIVERSITY OF RIO GRANDE ALUMNI MEMBERS

As Alumni of the University of Rio Grande – Saunders Insurance Agency appreciates the benefit of a quality education and is excited to offer Exclusive Savings from Nationwide specifically for other University of Rio Grande Members and Alumni.

Saunders Insurance Agency is now able to offer Exclusive Savings through Nationwide for University of Rio Grande Members & Alumni!!! Nationwide appreciate groups that bring people together over common values and interests. That’s why Nationwide is proud to offer exclusive discounts on insurance for University of Rio Grande Alumni & Members. Plus, Nationwide offers up to 20% savings when you bundle your home and auto insurance.*

With more than 90 years of experience and expertise, Nationwide can help you protect what matters today and plan for what comes tomorrow.

Nationwide is a Fortune 100 company based in Columbus, OH offering a full range of insurance and financial services across the country, including car, motorcycle, boat, homeowners, pet, farm, life and commercial insurance, as well as administrative services, annuities, mortgages, mutual funds, pensions, long-term savings plans and specialty health services.

*Savings compared to stand-alone price of each policy, based on national sample customer data from 2017. Discount amounts do not apply to all coverage or premium elements; actual savings will vary based on policy coverage selections and rating factors. Nationwide has made a financial contribution to this organization in return for the opportunity to market products and services to its members.

Halloween Safety

Posted October 24, 2018

5 Questions to Ask to Keep Your Haunting Brood Safe on Halloween

Despite the fact that Halloween Trick or Treat in Gallipolis, Ohio involves walking around at night amongst ghouls and witches, it really only takes a little common sense to make the night safe for everyone.

Here are five questions to ask so your entire family, even pets, can enjoy a safe and fun evening of trick-or-treating or handing out candy to others:

1. Are we visible?

Add reflective tape to costumes, clothing and candy bags to make it easier for drivers to see you and your group. That also goes for pets who are tagging along. Put reflective tape or flashing lights on their leashes or collars. Carrying flashlights and glow sticks is a good idea as well — they make you more visible and help you see better, too.

2. How safe are our costumes?

Costumes, including masks and shoes, should fit well to prevent blocked vision, trips and falls. Baggy clothing can also increase the risk of contact with candles. If you purchase costumes, make sure they are marked as flame-resistant. And accessories such as swords and knives should be soft and flexible.

3. Where are we going?

It’s best to have a plan before taking your kids trick-or-treating. You should only go to known neighborhoods and houses that have outside lights on, and children should never enter someone’s home unless an adult is with them. If you have older children going out on their own, have them tell you their plan.

4. What are the kids eating?

It’s always a good idea to examine the items your kids have collected before they dig in. And it’s not just about tampering, either. Be aware of choking hazards, too, particularly for young children. And remember, when it comes to eating treats, moderation is key.

5. How are Fido and Fluffy doing?

Even if your dogs and cats are just hanging out at home while you hand out candy, don’t forget about them. They shouldn’t eat candy at all, but especially chocolate, which can be toxic. Make sure candles are placed in areas where they won’t be knocked down. And remember that, depending on your pet’s personality, having people constantly coming to your door can be stressful. You might want to create a comfortable spot for them away from your home’s entrance.

With the right plan, you can make Halloween fun — and safe — for your little ghosts and goblins. And you can probably snag a little leftover candy for yourself, too.

A Few Tips for the College-Bound

Posted August 23, 2018

College is expensive enough without the added cost of unexpected accidents or theft, not covered by your insurance policy. If you have a student heading away to school, below are a few tips to help you get the most out of your coverage.

HOMEOWNERS (varies by state)

-

Personal Property: Most homeowners policies will cover personal property for up to 10% of your total policy while your child is residing at school (a $100,000 policy equals $10,000 in coverage). Not all types of damage are covered, so read your policy carefully. Some items such as jewelry or expensive electronics, require special coverage. Renters insurance is strongly recommended.

-

Liability Coverage: General damage to a dorm room or apartment is not usually covered.

-

Documentation: Creating an inventory of the items your child is taking to school is a good idea. Use photographs and keep receipts.

AUTO (varies by state)

-

Car Stays Home: Keep your child listed on your auto policy if they will still drive your car while at home on school breaks.

-

Car at School: Make sure to notify us if your child will be taking a car away to school. In most cases, if the car is registered to you and listed on your policy, it will be covered.

-

Driving a Friend’s Car: Students are generally covered if they are listed on their parent’s policy and are not regularly using the vehicle. The coverage would be secondary. The insurance for the friend’s vehicle would be the primary coverage.

-

Discounts: A full-time student meeting certain academic requirements can qualify for a good student discount. Distant student discounts may also be available. Drivers under 21 who have completed driver’s education may also get a discount.

Before your child leaves for school, call Saunders Insurance Agency at 740-446-0404 or email SIA at [email protected]. We can walk you through the steps to ensure you have the right coverage. We’re here to help!

Business Income Coverage Explained

Posted May 17, 2018

Business Income is possibly the most important insurance coverage that many businessowners don’t think about or overlook entirely. Saunders Insurance Agency is here to explain what Business Income coverage covers and why your business needs to ensure your policy includes adequate Business Income coverage.

Business Income Defined

First of all, it’s a good idea to know exactly what Business Income means. Your insurance policy defines Business Income as your Net Income (Net Profit or Loss before income taxes) that would have been earned or incurred AND Continuing normal operating expenses incurred, including payroll. Insurers pay Business Income if your business’ operations are suspended due to a covered cause of loss (such as a fire). In addition to Business Income, many policies add Extra Expense coverage within your Business Income limit. Extra Expense is defined as necessary expenses you incur during the "period of restoration" that you would not have incurred if there had been no covered loss. Insurers pay Extra Expense coverage to avoid or minimize the "suspension" of your business and to continue operations.

Calculating Business Income

Now that you know what Business Income coverage pays, let’s help you figure out how much coverage you need. Important questions to think about are: (1) How much time would it take to re-start your operations in the event of a worst-case loss? (2) What is your maximum probable loss? (3) How much are your fixed operational expenses (continuing expenses)?

The most accurate way to project your 12-month income is to use a business income formula or worksheet. To help this projection- you can work with this formula:

NET PROFIT + FIXED OPERATING EXPENSES* + ORDINARY PAYROLL

(Fixed Operating Expenses include Utilities, Rent, Lease Payments, Advertising, Interest Expense, Taxes, Insurance, and Salaries).

Once you’ve calculated the above Business Income figure, you’ll need to estimate the period of restoration. To protect your business, your estimate should be based on a worst-case scenario (think of a fire that destroys your building and the time it would take to rebuild). Your worst-case period of restoration may be 3 months, 6 months, 12 months, or longer. Multiply your Business Income figure by the number of months required to recover from a worst-case scenario and you have your Business Income Exposure Amount.

Coinsurance for Business Income

Most Business Income insurance forms include a coinsurance clause with a % listed on your declarations which imposes a penalty if the limit on your policy is less than the required amount. The coinsurance % may be anywhere from 50% to 125%. This indicates the amount of insurance you must carry to avoid a penalty.

For example, suppose that you have purchased business income coverage based on an income projection of $1,000,000. Your policy includes a coinsurance requirement of 80%. To avoid a penalty, you must purchase a limit of at least $800,000 (.80 X $1 million).

Business Income: Businessowners Policy Vs. Commercial Business Package Policy

If you own a small business that is covered through a Businessowners Policy- or BOP- your Business Income coverage is most likely for 12 Months- Actual Loss Sustained. Some BOPs will extend to 24 Months- Actual Loss Sustained but the majority of BOPs include 12 Months Business Income coverage.

Mid to Large Sized Businessowners need to be alert to the fact that their Business Income coverage may not be automatic. Most Commercial Business Package- or CBP- policies do not automatically include Business Income coverage or else limit the coverage to a low limit such as $25,000. Commercial Business Package policies usually offer coverage an a la carte basis with the business owner choosing between 2 types of Business Income options. A CBP policy may offer 12 Months- Actual Loss Sustained Business Income or require a specified coverage limit. If a specified coverage limit is required, the business owner will need to calculate his Business Income coverage using the method explained above and ensure that the coverage meets any coinsurance requirement.

Rental Car Insurance

Posted March 14, 2018

Do you need rental car insurance?

You’ve probably been at the rental-car counter, listening to the representative ask if you want to purchase the company’s insurance. And the thoughts start racing through your head. “Is this a rip-off? Doesn’t my regular auto policy cover me? What about my credit card? Why didn’t I figure this out before I left on my trip?”

At Saunders Insurance Agency, we are here to help. And while not every situation is the same, we’ve got some general tips that will help you make an informed decision the next time you’re standing at that counter.

1. Know your personal auto policy.

Because insurance policies vary, it’s a good idea to give us a call — before you rent a car — to make sure you have the coverage you need. In many instances, your personal auto policy will provide coverage for a rental car — but that coverage may be limited to the value of the car you own, rather than the one you’re renting. Of course, if you don’t have a personal auto policy, you’ll need to purchase coverage from the rental company.

And keep in mind that in the event of an accident, many rental companies will charge fees beyond repair costs. They may assess a loss-of-use fee for each day the car is unusable, as well as charge you because the value of the car has decreased. Not all insurance policies cover these fees.

2. Also know your homeowners or renters policy.

If you’re traveling with expensive electronics or other valuable items, you probably want to consider what coverage you’ll have in the event they are stolen. Your personal auto policy and/or credit card coverage likely won’t provide protection for this scenario.

3. Check your credit card protection.

Most credit cards will also provide some coverage, but often payment is limited to reimbursement of your personal auto policy deductible (after that policy pays for repairs). Generally, loss-of-use and other fees are not covered, but it’s important to check with your credit-card provider to determine their policies. And while some cards may offer additional protection for a fee, usually coverage is limited to damage to the car, not liability for any injuries to others. Remember, to receive any sort of benefit from your card, you must use that card to pay for your entire car rental.

4. Consider any unique circumstances.

Are you renting a car in a foreign country, or for more than a week? You’ll definitely want to get confirmation of coverage from both your insurance carrier and credit card company because different rules might apply. Also, no matter where you are, vehicles such as trucks, RVs or exotic sports cars often aren’t covered under standard agreements. And if you’re using a car for business purposes, your personal coverage might not apply. Finally, if multiple people will be driving the car during your trip, make sure your coverages will apply to them.

5. Learn about the insurance offered by the rental car company.

According to the Insurance Information Institute, rental companies offer four main types of coverage.

-

A Loss Damage Waiver (LDW) relieves you of responsibility if your rental car is damaged or stolen. This may also provide coverage for loss of use.

-

Liability Protection provides protection from lawsuits if you are sued after an accident.

-

Personal Accident Insurance covers you and passengers for medical bills after an accident. You may not need this if you have adequate health and auto coverage.

-

Personal Effects Coverage protects you if items are stolen from your car. You generally are covered for this under your homeowners or renters policy, but keep in mind that the loss must exceed your deductible for you to receive payment. If you have a high deductible, it may make sense to purchase this coverage from the rental company.

When you go on vacation, you don’t want to stress out about insurance. So give us a call before you leave. Then, when you head over to the rental-car counter, you can stop worrying about your coverage — and start enjoying your trip!

Healthy Tips to Kick-Start 2018

Posted on January 8,2018

Be the pinnacle of health and wellness this New Year

It goes without saying that keeping yourself and your family healthy through the harsh Winter in Ohio and West Virginia can be a challenge. When you combine chillier temps, housebound days, and post-holiday exhaustion - not to mention kids passing around colds at school like they’re playing “Hot Potato” - you can end up spending Winter under the covers.

No matter how many inherent seasonal risk factors you face, there are ways to prepare for and get through the season virtually unscathed. At Saunders Insurance Agency, we wish you a happy and abundantly healthy New Year, so here are a few tips to help you stay well!

Consider ‘sticking it’ to The Flu. Flu shots are readily available at your favorite Nurse Practitioner’s office- whether it be at Canaday Care or Holzer Pharmacy at Fruth in Gallipolis. Discuss with your doctor the pros and cons of flu shots for yourself and your family.

Get some zzz’s. The holiday hustle and bustle can interfere with normal sleep patterns, yet sleep is essential to health and healing. Prioritize getting enough sleep - or taking a quick nap - despite your busy schedule.

Fill the fridge. It’s easy to allow your pantry to start looking like a sweet shop after the holiday season ends. Take care to stock your refrigerator and cabinets with healthy snacks and ingredients for balanced meals. Think fruit, nuts, lower-calorie snacks, veggies and lean proteins.

Get real. Emotional health is important, too, so be realistic about what can be expected throughout the season. Just because it’s a new year doesn’t mean that Aunt Mary and Uncle Joe from West Virginia will finally mend their rocky relationship.

Keep moving. Despite the freezing temptation to bundle up and relax, don’t give in to being a couch potato. Get to the gym or yoga studio, go for a walk in the City Park, jump on the treadmill or play in the snow. The important thing is to just move!

From the Saunders Insurance Agency to you, we wish you a happy and healthy 2018!

Simple Answers to your Home Insurance Questions

Posted on November 9, 2017

Q: Why is my home covered for more than it’s worth?

A: Most home insurance policies insure your dwelling for what is called “Replacement Cost” coverage which pays to replace your property regardless of the home’s purchase price. Replacement Cost calculates the amount of money it would take to replace your damaged or destroyed home with the exact same or a similar home in today's market- which is typically higher than your home’s market value.

Q: What exactly does my home insurance cover?

A: Most home insurance policies are written on what is called an HO-3 form which covers your home against 16 common perils: fire or lightning; windstorm or hail; explosion; riot or civil commotion; damage caused by aircraft; damage caused by vehicles; smoke; vandalism or malicious mischief; theft; volcanic eruption; falling objects; weight of ice snow or sleet; accidental overflow of water from within a plumbing HVAC system; sudden and accidental tearing apart cracking burning or bulging of a HVAC system; freezing of plumbing and other systems; and damages from artificially generated electrical currents.

Q: Does my home insurance cover my contents/personal property while on vacation?

A: Yes. Your Home insurance’s “Personal Property-Coverage C” limit provides coverage to your personal property wherever you are. Even if you lose a valuable item while in another country on vacation- you’re covered- provided the loss is by a covered peril or event (as mentioned above).

Q: What damages are excluded on my home insurance?

A: Home insurance exclusions differ between companies and states but the most common excluded perils include Floods and Earthquakes. Other home insurance exclusions are neglect/failure to make repairs, wear and tear, animals and pests, fungi, nuclear hazards, power failure, government actions and war. However, earthquake coverage can be purchased and added to your policy for an extra premium while flood insurance must be purchased separately from your home insurance.

Q: If I work at home, is my business property covered under my home insurance?

A: Yes, BUT within certain limitations. Your business personal property is covered as personal property used for business purposes. However, there are special limits for business personal property. Most home insurance policies provide a sub-limit of between $1,000-$5,000 for business personal property.

Whether your home business is your primary occupation or a side hustle than nets a few thousand dollars a year, it’s still a business. You should treat it as such. If you've invested quite a bit in business equipment or inventory and sell the occasional home-made product, you should consider whether the business personal property sub-limits are sufficient.

Q: Can my home insurance provide coverage for my jewelry?

A: Yes- but you will need to schedule your jewelry to be covered in full. Most home insurance policies provide a sub-limit of $1,000-$5,000 for jewelry theft and mysterious disappearance but higher limits or specific items would need to be specifically scheduled.

Other personal property items that have special sub-limits include: money, securities, stamps, gold, silver, coins, watercraft, trailers, firearms theft, theft of silverware/goldware, and as mentioned above- property used for business purposes

Q: My child is away at college. Does my home insurance personal property limit extend to his dorm?

A: Yes. Your home insurance will extend up to 10% of your “Personal Property- Schedule C” limit to your child while he is away at school. Additionally your home insurance’ Personal Liability limit will also extend to your child at school.

Q: What does my homeowners’ insurance protection class mean?

A: Home insurance is rated off your home’s protection class- which considers your responding Fire District, distance to the responding Fire Department, and distance to the nearest Fire Hydrant. The best protection class is a 1, while the worst protection class is a 10. Homes located in Gallipolis, OH within 5 miles of the Gallipolis Fire Departments and within 1,000 feet of a fire hydrant are rated as Protection Class 5.

Q: Does my home insurance cover breakdown of appliances such as washers, dryers, refrigerators, or heating & cooling systems?

A: Only if your policy includes Equipment Breakdown- which must be purchased extra. Equipment Breakdown coverage provides protection in the event of an unexpected mechanical or electrical breakdown not caused by normal wear and tear or corrosion. Typical household items covered include washers and dryers, dishwashers, refrigerators, heating & A/C systems, water heaters, heat pumps, and computer equipment. This extra coverage typically costs an extra $25 annually.

Q: What does Personal Liability cover?

A: Personal Liability provides coverage in the event an accident occurs in or out of your home that results in bodily injury or property damage that you are held legally responsible for. Your personal liability limit- for which we recommend $500,000- will protect you from lawsuits you may face from an accident, bodily injury to an individual, or property damage that occurs as a result from your negligence. However, there are instances which would be excluded such as bodily injury or property damage caused intentionally by you or a family member or as result from your business activities.

Scott W Saunders, of Saunders Insurance Agency selected for Insurance Business America's Young Guns 2017 Rankings

Posted on August 31, 2017

Scott W Saunders, of Saunders Insurance Agency has been selected as one of Insurance Business America’s Young Guns 2017 Rankings. Insurance Business America’s Young Guns rankings consist of insurance industry innovators creating the next great insurance products, entrepreneurs who branched out to start businesses of their own and producers whose books of business rival those of top industry veterans. Collectively, these individuals – all age 35 and younger – are inspiring their peers with their expertise and passion for the industry. In today’s competitive insurance market, standing out amidst a pool of immense talent can be a challenge. Yet these 55 young professionals have risen above the pack by blending 21st-century moxie with old-school work ethic.

The IBA Young Guns 2017 Rankings appears in Insurance Business America issue 5.08 released on August 19,2017. Insurance Business America’s Young Guns rankings can also be viewed at http://www.insurancebusinessmag.com/us/rankings/young-guns-2017/

5 Alarms to Consider for your Ohio Home

Posted on May 23, 2017

What alarms and sensors do you need in your Ohio or West Virginia home? The answer is different for everyone. But, whatever your situation, today’s technology has you covered with options including online monitoring and more. Here are some common alarms, including two everyone needs to have, and three many people should at least consider:

-

Smoke alarms

No matter where you live — house, condo, apartment — you need smoke alarms. Place one in every room where people sleep, and at least one on each level of your home. Consider alarms that work for both flaming and smoldering fires (they’re different), as well as an interconnected system so that all alarms sound when one detects smoke.

-

Carbon-monoxide (CO) detectors

Here’s another must-have. CO — a deadly, odorless gas generated by the burning of fuels such as wood, natural gas or propane — kills hundreds of people a year in the U.S. You should have at least one CO detector on every level of your home, even if you only have electric appliances and heat sources. Your state may even require you to have one.

-

Natural gas detectors

These alarms usually detect CO and propane leaks, so consider one if you have natural gas appliances in your home. You also need one for your RV or trailer if you use propane to fuel your cooking or heating.

-

Water alarms

Leaks from appliances or pipes can do extensive — and expensive — damage to your home if they go undetected. Water alarm systems typically use sensors placed near appliances or other trouble spots to alert you when they sense moisture.

-

Security systems

Whether you want a do-it-yourself system or one that is professionally monitored, you’ve got more options than ever before. You may even be able to check in on your home from wherever you are using your smartphone.

-

When you’re making these important decisions, here’s one more important thing to consider: Some of these alarms could qualify you to save on your homeowners insurance in the states of Ohio and West Virginia! Call SIA at 740-446-0404 to learn more.

Simple Answers to your Car Insurance Questions

Posted on April 10, 2017

Here’s simple answers to our most frequently asked auto insurance questions:

Q: What does “full coverage” mean?

A: Full coverage means your vehicle insurance includes liability, comprehensive, and collision insurance.

Q: What does $100,000/$300,000/$100,000 liability mean?

A: This means that you your insurance will provide $100,000 bodily injury per person with $300,000 bodily injury per accident. The last $100,000 is available for property damage liability.

Q: Who offers the cheapest car insurance in Ohio?

A: Grange Insurance is rated the cheapest option for good drivers, young drivers, & retired drivers in Ohio by NerdWallet. Erie was rated cheapest for those with poor credit in Ohio.

SIA offers Grange Insurance.

Q: Who are the best car insurance companies?

A: NerdWallet ranks Amica, Erie, Auto-Owners, Country Financial, Nationwide, Geico, American Family, Allstate, The Hartford, Liberty Mutual & Safeco in their Top 11.

SIA represents 6 of the top 11 carriers: Auto-Owners, Nationwide, Allstate, The Hartford, Liberty Mutual & Safeco.

Q: What in the world does “bundling” mean?

A: Bundling is combining multiple policies with the same company- such as having your home, auto, & business insurance with the same carrier.

Q: What’s the best way to save money on car insurance?

A: Shopping around and looking for various discounts (bundling, mature driver, good student, alumni discounts). Having an independent agent allows you to shop around multiple companies without having to do it yourself.

Q: What state would my coverage need to be through if I live in West Virginia but have an Ohio drivers license?

A: Your insurance would be purchased in the state that your vehicle is “garaged”- West Virginia in this case.

Q: When do I have to add my teenage driver to my insurance?

A: When your teenager actually passes the exam and is given a valid drivers license.

Q: What’s the cheapest route to add a teen driver- on his or her parent’s policy or on a separate policy?

A: Most of the time it is cheaper to add a teen driver to the parents policy.

Q: How much will my auto insurance increase after an at-fault accident in Ohio?

A: Ohio drivers can expect an average increase of $763 annually after an at-fault accident & $912 if the accident included bodily injury damages according to CarInsurance.com

Q: How much will my auto insurance increase after a speeding ticket?

A: You can expect an increase of $100-$150 a year according to NerdWallet

Q: Your friend borrows your car and crashed it, whose insurance will pay?

A: Your insurance will pay for any damage to your own vehicle (assuming you have physical damage coverage). However, your friend’s insurance may pay any liability damage to others as many Ohio insurance carriers are starting to follow the driver for liability coverage.

If there’s a question we haven’t covered or you’re looking to shop around call Saunders Insurance Agency at 740-446-0404.

Avoiding Distractions While Driving Could Save Your Life

Posted on March 6, 2017

The Wall Street Journal recently reported that distracted driving is attributing to a rise in auto accidents and is pushing auto insurance rates higher. The number of deadly accidents jumped 7.2% in 2015, according to the National Highway Traffic Safety Administration. A recent report from the nonprofit National Safety Council showed an estimated 6% rise for 2016.

Distracted drivers in come in all shapes, sizes, ages and experience levels. Even if you’re not one today, you could become one at any moment — in the time it takes you to answer your cell phone or check the kids in the back seat when you’re driving through your Gallia County neighborhood.

If you or someone else you know thinks you can drive just fine while talking on your phone, think about this: More than 450,000 people were injured in crashes that reportedly involved distracted driving in 2009, according to the National Highway Traffic Safety Administration. More than 5,000 of those people died.

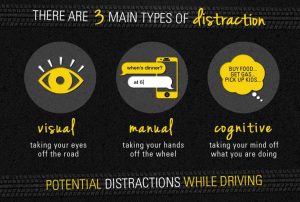

Distractions on the road come in many forms, according to www.distraction.gov, a U.S. Department of Transportation website. There are three main kinds of distractions:

Visual – taking your eyes off the road

Manual –taking your hands off the wheel

Cognitive – taking your mind off what you’re doing

To help you avoid all three kinds of distractions the next time you’re behind the wheel of your car here are a few tips:

-

Put your phone in silent mode and store it away from the front seat or in a purse or bag. This helps reduce temptation.

-

Have a passenger answer your phone or return text messages for you.

-

If a call or a text can’t wait, pull over in a safe spot before using your phone.

-

This one seems obvious, but finish shaving or applying makeup before you get in the car!

-

If you’re emotional, wait until you’ve calmed down before hitting the road.

-

Avoid road rage. You’ll be happier and safer.

Whenever you’re on the road, it’s not a time to multi-task. Focus on driving safely.

Prevent Christmas Tree Fires

Posted on December 14, 2016

5 TIPS TO HELP PREVENT CHRISTMAS TREE FIRES

Christmas trees are a beloved holiday tradition in Ohio and West Virginia but they can pose a fire risk. On average, says the National Fire Protection Association, fire departments across the country respond to more than 200 blazes related to holiday trees each year

Despite how much we here at Saunders Insurance Agency support our local firefighting heroes, we hope they won’t have a reason to show up at your doorstep this holiday season. So, here are our common-sense suggestions for enjoying a Christmas tree safely:

-

If you opt for an artificial tree, be sure it has a flame retardant label or certification. If you’re picking out a live tree, forgo the one with brownish needles that are falling out – it’s too dry. Instead choose one with fresh, green needles that don’t fall out even when you shake the limb.

-

Place your live tree in water as soon as possible, using about a quart of water per each inch of stem diameter. Before you do, however, make a fresh cut from the stem bottom – straight across – to help the tree get water. Replenish the water regularly.

-

Situate the tree so you can still access the exits in the room, and keep it at least 3 feet away from open flames or heat sources, such as your fireplace or radiator.

-

Now it’s time for the best part – trimming the tree. Choose lights and other decorations labeled as flame retardant, and make sure your lights don’t have frayed or worn wires. Leaving the house or going to sleep? Be sure to unplug those lights.

-

It’s always a chore – and somewhat of a bummer – to take down the tree each year, but do so sooner rather than later, especially with a live tree. Otherwise you prolong your risk of a fire. Check for tree recycling options in your area for responsible disposal.

No matter if you trim your tree with popcorn or with heirloom ornaments, we hope it brings the magic of the season alive for you and your loved ones this year. Happy holidays from all of us at Saunders Insurance Agency

What Happens to Obamacare under President Trump

Posted on November 14, 2016

President-Elect Donald Trump has pledged to dismantle the Affordable Care Act- better known as Obamacare- by repealing and replacing the law. Here’s what dismantling Obamacare could actually look like- according Mr Trump’s Healthcare Reform Paper released during the campaign and subsequent comments post-election.

REPEAL: This is the single most talked about and debated feature of the President-Elect’s plan. However, it would be extremely unpopular to take away subsidies allowing millions of Americans to purchase coverage through the exchanges and state Medicaid programs. Given the unprecedented act of rolling back such a large public benefit, the GOP and Mr Trump will need to ensure replacement plans go hand in hand with any repeal. In fact, Mr Trump’s Healthcare Reform White Paper highlights the need to eliminate the individual mandate under the “completely repeal Obamacare” bullet. It’s much more likely that President-Elect Trump will choose to keep some popular aspects of Obamacare – such as the insurer ban on excluding coverage for preexisting conditions and the ability to keep children on their parents’ plan up to age 26. The actual dismantling will more likely be a step by step repeal of unpopular portions such as the individual mandate fine, medical loss ratio, & Medicare payroll tax.

HIGH RISK POOLS: Trump has also proposed High Risk Pools for uninsurable individuals to help offset the repeal of the individual mandate. High Risk Pools act as plans for people with pre-existing conditions and were used by many states before the Affordable Care Act was passed.

ERASING STATE LINES: President-Elect Trump has vowed to remove the constraint that forces health insurers to offer coverage on a state by state basis. In his HC Reform Whitepaper, Mr Trump states that he will “Modify existing law that inhibits the sale of health insurance across state lines. As long as the plan purchased complies with state requirements, any vendor ought to be able to offer insurance in any state. By allowing full competition in this market, insurance costs will go down and consumer satisfaction will go up”

TAX RELIEF: President Obama uses the IRS to qualify individuals and families for tax subsidies that offset the high cost of coverage. President-Elect Trump proposes to “Allow individuals to fully deduct health insurance premium payments from their tax returns under the current tax system. Businesses are allowed to take these deductions so why wouldn’t Congress allow individuals the same exemptions? As we allow the free market to provide insurance coverage opportunities to companies and individuals, we must also make sure that no one slips through the cracks simply because they cannot afford insurance. We must review basic options for Medicaid and work with states to ensure that those who want healthcare coverage can have it.”

HEALTH SAVINGS ACCOUNTS: Under Obamacare, many carriers are offering Health Savings Accounts (HSAs) as alternative plans to offset premium increases. President-Elect Trump proposes to continue the HSA proliferation by allowing “Contributions into HSAs should be tax-free and should be allowed to accumulate. These accounts would become part of the estate of the individual and could be passed on to heirs without fear of any death penalty. These plans should be particularly attractive to young people who are healthy and can afford high-deductible insurance plans. These funds can be used by any member of a family without penalty. ”

COST TRANSPARENCY: President-Elect Trump also plans to laser in on high healthcare costs that drive insurance premiums upward. Trump vows to ” Require price transparency from all healthcare providers, especially doctors and healthcare organizations like clinics and hospitals. Individuals should be able to shop to find the best prices for procedures, exams or any other medical-related procedure.”

MEDICAID: President-Elect Trump wants to return the administration of Medicaid over to the states. Trump proposes to “Block-grant Medicaid to the states. Nearly every state already offers benefits beyond what is required in the current Medicaid structure. The state governments know their people best and can manage the administration of Medicaid far better without federal overhead. States will have the incentives to seek out and eliminate fraud, waste and abuse to preserve our precious resources.”

CHEAPER DRUGS: President-Elect Trump also proposes to “Remove barriers to entry into free markets for drug providers that offer safe, reliable and cheaper products. Congress will need the courage to step away from the special interests and do what is right for America. Though the pharmaceutical industry is in the private sector, drug companies provide a public service. Allowing consumers access to imported, safe and dependable drugs from overseas will bring more options to consumers”

Read President-Elect Trump’s Healthcare Reform White Paper in its entirety here.

FiveThirtyEight also has a useful article on What Will Trump Do To Obamacare?

Back to School Safety

Posted on August 23, 2016

AS KIDS HEAD BACK TO SCHOOL, LET’S KEEP THEM SAFE

The end of summer means many things, such as cooler weather, shorter days and … the start of football here in Ohio and West Virginia.

But most important, it means kids are headed back to school. And that means we all should be extra careful on the roads, in school zones and around buses in Gallia, Meigs, Athens, Jackson and Mason Counties. Remember to watch for bikes, too! Here are some tips for both parents and kids to make sure everyone stays safe.

Use caution on the roads

-

There are going to be a lot more kids on the sidewalks and streets when school starts, so take it slow and always be aware of your surroundings. That’s good advice for all situations, of course, but be extra cautious around the times when school starts and ends for the day.

-

Watch out for school zones! They’re usually easy to spot, as many have flashing signs indicating a slower speed limit.

-

Remember to follow school-bus rules. You aren’t allowed to pass the bus on either side of the road when the red lights are flashing. Even when the lights stop, make sure the coast is clear before moving on. Kids can move quickly and erratically.

-

Leave yourself extra time to make it to your destination. Whether you’re headed to work or dropping your child off at school, rushing is a recipe for disaster.

-

Be especially careful in school or child-care parking lots and loading zones!

Teach kids to be safe while walking

Just a few minutes spent explaining some basic safety rules to your child can help keep them safe when they’re walking to or from school. Young children should never cross streets alone, but if your child is old enough to walk with others, remind them to do the following:

-

Always use marked crosswalks when crossing streets and look both ways twice.

-

Do not assume that drivers can see you. Try to make eye contact with them, if possible, when crossing the street.

-

Watch for driveways when walking on the sidewalk.

-

Be aware of cars that are turning or backing up.

-

Never move into the street from behind a car or other obstacle. Don’t chase a ball, pet or anything else into the street.

-

Always use sidewalks and paths. If there is no sidewalk or path, walk facing traffic and as far to the left as possible.

Help them stay safe on their bikes

Just as it’s important to help your children learn safety tips for walking to and from school, it’s important to teach bike safety, especially by setting good examples yourself.

-

Make sure your child wears a properly fitted helmet every time he or she rides a bike.

-

Before the bicycle is ridden, do a quick inspection to ensure it is working properly and reflectors are in place.

-

Show your kids how to ride on the right side of the road with traffic and to stay as far to the right as possible.

-

Encourage your child to walk his or her bike across busy intersections. Or better yet, choose a route without any busy crossroads.

-

Explain to your child why no one should ride on the handlebars.

-

Demonstrate the rules of the road by using proper hand signals and obeying traffic signs when you ride bikes together with your child.

-

Set curfews so your child is not riding a bicycle at dusk or in the dark.

-

Most importantly, supervise your children every time they ride until you are certain they have good judgment.

We know you’re probably familiar with all of these good ideas, but everyone needs reminders. So take it slow, and let’s have a happy and safe school year!

Insurance Tips for Graduates

Posted on May 20, 2016

PROTECT YOUR COLLEGE GRAD WITH THE RIGHT INSURANCE

College graduation is an exciting time for students and their parents alike. And, while it’s easy to be immersed in grad parties and focused on first-job jitters- it’s a time of major transitions and big decisions. It’s essential to prepare graduates for what comes next.

One area new college graduates need to address is insurance. As insurance professionals at Saunders Insurance Agency, we know insurance can be a confusing topic. We also know seemingly small missed details can lead to very large losses. At SIA, we want to ensure your college graduate is protected before heading out into the real world- so we’ve compiled the following pointers:

-

Review your family’s current insurance. The first step when considering insurance for your new graduate is evaluating the coverage you currently have. Make an appointment with your agent for advise on the pending changes and ensure your recently graduated son or daughter will be covered.

-

Know the law. Ohio and West Virginia require drivers to have auto insurance, and each have have separate minimum policy limit requirements. If your graduate is moving to a new state- research the law in your son or daughter’s state, or consult with your agent, to make sure they are covered adequately.

-

Read your lease. Many apartment, condominium and home rental properties require tenants to maintain a certain level of renter’s insurance, which covers the contents of the home in the event of a robbery, fire, or other loss. Make sure you know the terms of your son or daughter’s new lease, and insure them accordingly.

-

Don’t end up liable. Any home renter or owner is exposed to liability risk. To ensure there is adequate coverage in the event someone gets injured on your son or daughter’s property, speak with your agent about liability insurance.

-

Don’t gamble! Never go without. It’s simple: your son or daughter should always have insurance in place. Be sure to discuss with your agent what types they need.

-

Know your company benefits. Many college graduates move straight into the workforce, and most companies have benefits. Study the company’s human resources handbook to learn what benefits are available, when they go into effect, and what their limitations are.

Saunders Insurance Agency would like to congratulate you, your daughter, or your son on your graduation success!!! Please contact us at 740-446-0404 with any questions, or to request a review of your family’s insurance portfolio.

A Time to Celebrate Mothers

Posted on May 5, 2016

As the second Sunday of May nears, it’s time to think of ways to celebrate mothers – although, of course, that’s a worthy pursuit at any time of year!

At Saunders Insurance Agency we thought it would be fun to give you a little of the history behind Mother’s Day, as well as a few ideas to honor the special women in all our lives.

Ancient beginnings

According to MothersDayCentral.com, the ancient Egyptians held an annual festival to honor “the mother of the pharaohs” – the goddess Isis. This is one of the earliest historical records of a society celebrating a mother.

How Mother’s Day came to be in the U.S.

In 1870, Julia Ward Howe, a social activist and poet (and author of the lyrics for “The Battle Hymn of the Republic”) had became distraught by the toll of the Civil War. She issued a “Mother’s Day Proclamation” that year, calling on mothers to protest the killing and create a day celebrating peace and motherhood.

Howe’s proclamation did not result in a national Mother’s Day, but in 1908, Anna Jarvis of West Virginia took up the cause. She wanted to accomplish her mother’s dream of making a celebration of all mothers. By 1909, more than 40 states were holding Mother’s Day services, even though it was not a national holiday.

In 1912, according to Wikipedia, West Virginia was the first state to officially observe Mother’s Day. Jarvis continued to promote the day until President Woodrow Wilson made it an official national holiday in 1914.

She later regretted creating the holiday, believing that it had become too commercialized.

Enough with the history – where are the gift ideas?

Like us at Saunders Insurance Agency we know you might have more urgent concerns on your mind, like last-minute shopping, so here are the most popular Mother’s Day gifts, according to MothersDayCentral.com

-

Flowers

-

Gift baskets

-

Personalized gifts

-

Jewelry

-

Perfume

-

Spa gifts

-

Magazines

Of course, perhaps the best gift of all is getting in touch and letting the moms in your life know just how much they mean to you. Happy Mother’s Day!

Taxes & Identity Theft: 4 Things to Know

Posted on April 6, 2016

4 THINGS TO KNOW ABOUT TAXES & IDENTITY THEFT

In 2014, almost 18 million people in the U.S. were victims of identity theft. Two-thirds of them said they suffered a direct financial loss because of it, according to the Bureau of Justice Statistics (BJS).

During tax season, your personal information is particularly vulnerable. After all, your Social Security number (SSN) is on W-2 forms, your tax return and other financial documents being sent through the mail, transported to accountants and otherwise used to complete your annual IRS ritual. So it’s a good time of the year to be especially vigilant.

To help, here are four things you should know about identity theft- from what thieves can do to how you can help protect yourself- from the Internal Revenue Service (IRS) and Federal Trade Commission:

-

Thieves won’t just open new accounts — they can (and will) file “your” taxes. Someone with access to your data could file a fraudulent tax return and claim a refund under your name. You may not know until you go to file your own return and it comes back rejected. If it happens, call the IRS Identity Protection Specialized Unit at 1-800-908-4490.

-

Scammers will try to reel you in. Ever get a call or email from someone asking you to verify your account information or SSN? Legitimate organizations, especially the IRS, won’t do that. If there’s a prob